Where people never (or hardly ever) sell

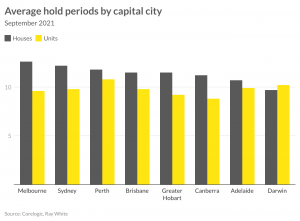

The average house is held for 11.4 years while for units, it is slightly less at 10.6 years. At a capital city level, Melburnians hold on to houses the longest (12.6 years), while for units, Perth owners hold on longest (10.8 years).

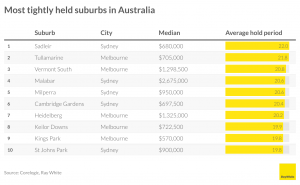

In some suburbs however, hold times are substantially more than this. In the south-western Sydney suburb of Sadleir, homes are held on average for 22 years, more than double the Sydney average. Melbourne’s Tullamarine came in second at 21.8 years. Surprisingly, the most tightly held suburbs were relatively affordable, although Malabar in Sydney’s south made the list with a median of $2.675 million.

What are some of the characteristics of tightly held suburbs that make people not want to let go?

- Contain a high proportion of older residents

Long hold periods for some suburbs reflect the lifecycle of the suburb. Many of these areas contain older people that would have bought when the suburb was just being developed. Over a long time period they have become attached to the suburb and have decided not to move

- Big homes on big blocks (but not too big)

Many of these suburbs contain large homes on decent sized blocks. It doesn’t include very large homes which could explain why older people are able to stay in the suburb

- Affordable

The suburbs aren’t particularly expensive. Which shows that you don’t need to live in the most expensive suburbs to enjoy living there

- Nice places to live

Many of the suburbs on the list are pretty nice places to live. They include established retail precincts and parklands. Most of them have decent public transport.

What will happen to interest rates in 2022? Probably nothing but inflation risks remain

No surprises that the RBA did not move on interest rates this week, despite inflation coming in at three per cent for the September quarter. The RBA aims to keep inflation between two and three per cent using monetary policy, hence why speculation ramped up that they would move early.

As discussed last week, high inflation was not surprising to anyone, let alone the RBA and was in fact widely predicted. As we get back to living more normally, we are spending more. At the same time, it is taking a bit of time for business to get back to full capacity. This is creating problems in supply chains particularly but is also exacerbating challenges like energy shortages. High inflation is not just an Australian problem, it is a global issue.

The big question now is as to whether high inflation will continue and the RBA have to move earlier than the 2024 date they predicted for an interest rate rise. There are two schools of thought. The first is that high inflation is temporary and will calm down once businesses get back to full capacity, supply chains work through the backlog and energy problems lessen. The second is that high inflation is here to stay for some time and to pull it back, interest rates will have to move upwards prior to the 2024 date.

For now, we need to watch and wait. December inflation will be high, particularly given the run up to Christmas and the end of border closures. It is unlikely that the RBA will move in December however pressure may start to build in early 2022.

If you have a home loan, or are looking to get one, then the best advice is to be prepared and make sure you are able to handle higher rates if they come in early.